The property tax situation in Illinois is a significant concern for both residents and policymakers.

1 Here’s a breakdown of the key issues:

High Property Tax Rates:

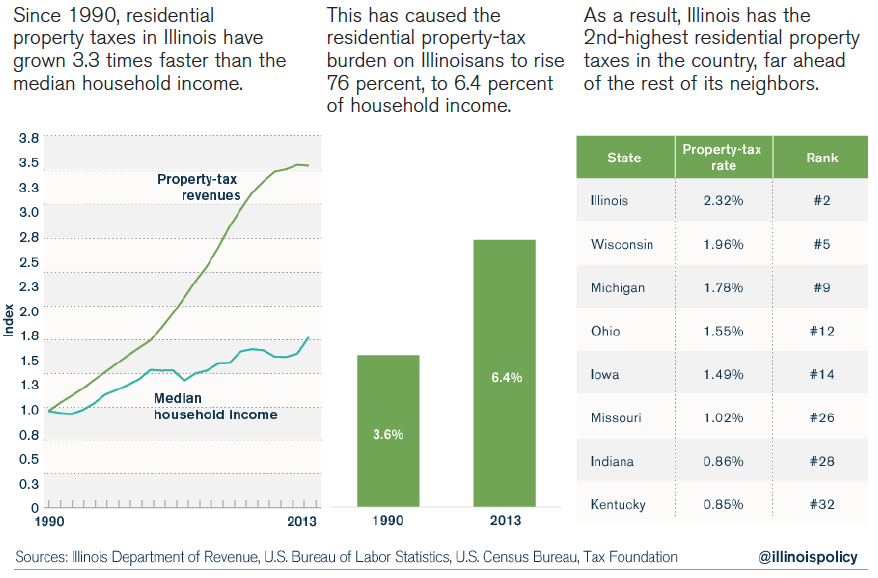

Illinois consistently ranks among the states with the highest property tax rates in the nation.

2 Reports indicate that Illinois homeowners pay significantly more than the national average.

3 This high tax burden places a substantial financial strain on homeowners.

Factors Contributing to High Taxes:

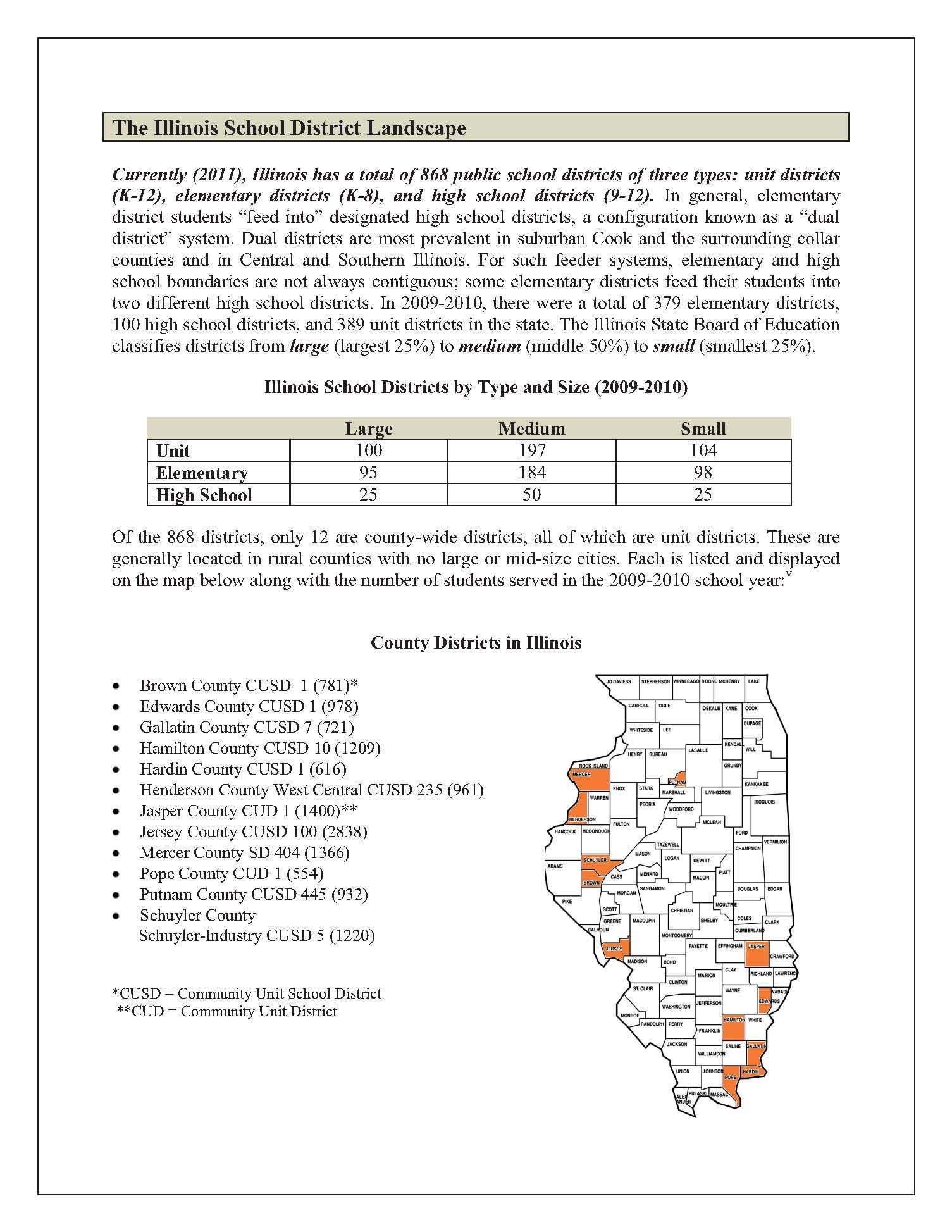

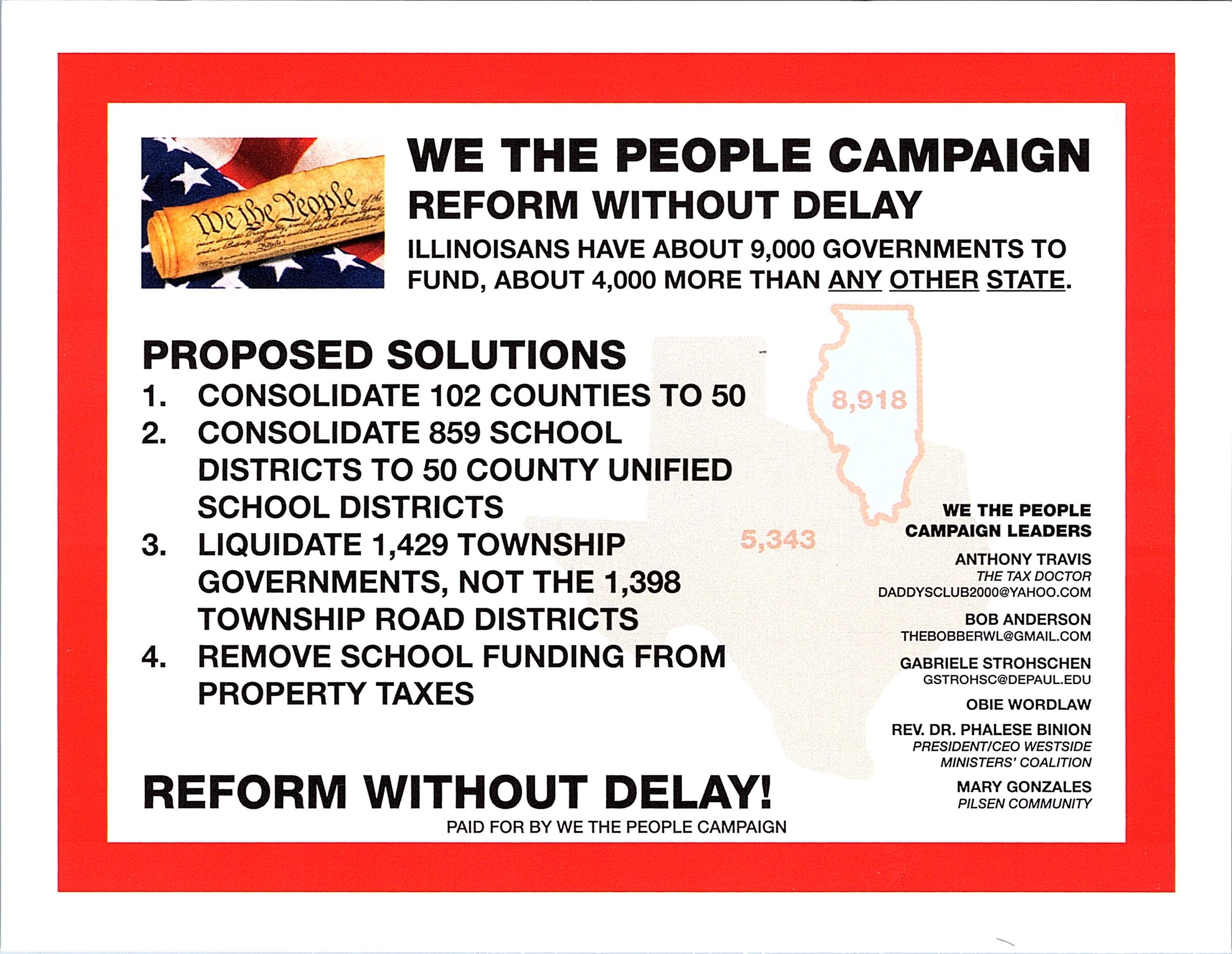

Local Government Units: Illinois has a large number of local government units, each with the power to levy property taxes.

4 This fragmentation contributes to the overall high tax burden.

School Funding: A significant portion of property tax revenue goes towards funding public schools.

Assessment Issues: There are instances of uneven or inaccurate property assessments, which can lead to unfair tax burdens.

5 As shown by the situation in Montgomery county, issues with how land is assessed can cause very large tax increases.

6 Impacts of High Property Taxes:

Population Outmigration: The high cost of property taxes is a significant factor driving residents to leave Illinois for states with lower tax burdens.

7 Economic Burden: High property taxes can make it difficult for families to afford housing and can hinder economic growth.

Public Perception: Many Illinois residents feel that they are not receiving adequate value for the high property taxes they pay.

Need for Change:

There’s a growing call for property tax reform to alleviate the financial burden on homeowners and improve the state’s economic competitiveness.

8 Possible reforms include:

Consolidating local government units to reduce costs.

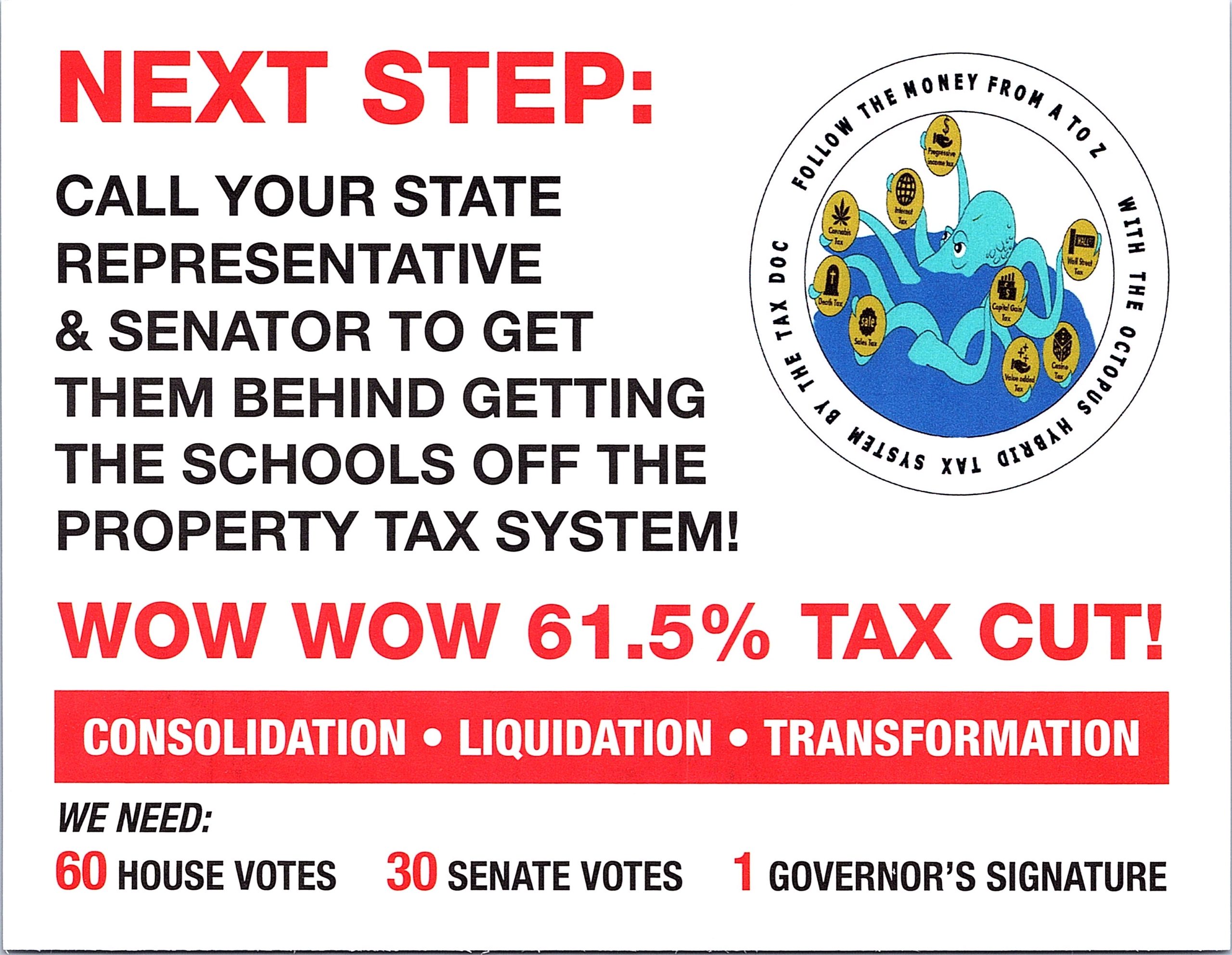

9 Exploring alternative funding sources for public schools.

Improving the accuracy and fairness of property assessments.

Implementing spending caps on governmental entities.

In essence, the Illinois property tax problem is a complex issue with deep-rooted causes and far-reaching consequences. Addressing this issue requires a comprehensive approach that considers the needs of homeowners, local governments, and the state as a whole.

This is the way we should and can fund schools.

Fifteen different methods are employed to fund schools.

Some states like Indiana have done what is necessary!

The Fix to fund schools:

Concerns about property taxes and their impact on homeowners are a significant issue. Here’s a breakdown of potential alternative funding sources for Illinois schools, keeping in mind the complexities of school finance:

State-Level Revenue Options:

- Increased State Income Tax:

- A progressive income tax system, where higher earners pay a larger percentage, could generate substantial revenue.

- Expanded Sales Tax:

- Broadening the sales tax base to include more services or luxury items.

- Increasing the overall sales tax rate.

- Statewide Business Tax:

- A revised corporate income tax structure that ensures fair contributions from businesses.

- Excise Taxes:

- Increased taxes on specific goods like tobacco, alcohol, or sugary drinks.

- Implementing a state-level tax on cannabis sales.

- Financial Transaction Tax:

- A small tax on financial transactions within the state.

- State Lottery Revenue Allocation:

- Increasing the percentage of lottery revenue dedicated to education.

- Public Utility Tax:

- Ensuring that public utility taxes are properly allocated to educational funding.

- Carbon Tax:

- A tax on carbon emissions, with the revenue directed towards education.

Local and Regional Options:

- Local Option Sales Taxes:

- Allowing local governments to implement additional sales taxes specifically for education.

- Regional Education Districts:

- Creating regional districts with shared funding mechanisms, potentially reducing administrative costs.

- Impact Fees:

- Charging developers impact fees for new construction to offset the increased demand on school resources.

Other Funding Strategies:

- Federal Funding:

- Actively pursuing and maximizing federal grants and funding opportunities.

- Public-Private Partnerships:

- Exploring partnerships with businesses and philanthropic organizations to support specific educational programs.

- Endowment Funds:

- Encouraging the establishment of endowment funds for school districts.

- Consolidation of School Districts:

- Streamlining administrative structures through school district consolidation to reduce overhead costs.

- Reviewing and Reducing Spending:

- Auditing and reviewing current spending to find areas where expenses can be reduced.

- Increase in fees for certain school activities:

- Where it is possible, and does not create an undue burden, increasing fees for certain non-essential school activities.

- Taxing online sales:

- Ensuring that online sales are taxed, and that those taxes are allocated to schools.

- Taxing vacant properties:

- Implementing a tax on vacant properties, which could encourage development and generate revenue.

Important Considerations:

- Any changes to school funding must prioritize equitable distribution of resources to ensure all students have access to quality education.

- Thorough analysis of the economic impact of each funding option is essential.

- Transparency and accountability in school finance are crucial for public trust.

It’s important to understand that school funding is a complex issue with no easy solutions. Combining these approaches may be necessary to create a sustainable and equitable funding system.

See the model for funding Illinois schools in ways other than Property Taxes

We are in a crisis that will only get worse. There are no viable solutions besides bills that remove school funding from property taxes. Illinois is spiraling down: Property taxes are killing the state. We are losing people to surrounding states. And they leave because of property taxes. Every time we lose a citizen, the tax per household rises because the financial burden does not change. We are seeing young people move out of the state to buy homes because of property taxes. Every time we lose a young person or couple to another state, we lose an opportunity to decrease our taxes. The tax burden stays the same because the cause is still the same or rises. When property taxes rise, the market value declines, but the tax burden does not change, so household wealth decreases. We have an opportunity for Speaker Welch to stop the downward spiral of the great state of Illinois.

Speaker Chris Welch can save this state by passing two bills for immediate relief: The first bill would stop funding education on property taxes, and the second would consolidate government units, including school districts.

People are losing their homes because homeowners cannot afford to pay the property taxes. People who have lived in a house and paid their mortgage for 20 years are losing their homes because our elected officials are not doing their job.

When we vote, we vote for people who will help communities have the necessities of life, like food, clothing, water, shelter, heating, and healthcare. The bare necessities of life that governments must provide include security, healthcare, education, infrastructure, housing stability, and social safety nets. —homeowners losing homes due to unaffordable property taxes—highlights a critical tension between funding public services and ensuring housing affordability.

People are losing their shelter because of property taxes. Senior citizens who have lived in their homes and paid their mortgages for years are losing their homes because of outrageous property taxes. Renters also suffer when property taxes rise. Rental unit rates are higher because of increased property taxes. To emphasize the destructive nature of high property taxes, losing a place to live is the worst-case scenario. However, the normative outcome is losing the capacity to have a decent life. High property taxes mean no travel, no vacation, no college for their children, and not being able to enjoy the things that that money could have been used for, often healthcare-related.

Download and complete the letter to >>> Speaker Chris Welch. Get your signature to him before March 21st, 2025. And share profusely!

Contact Speaker Welch’s Executive Assistant Mika Baugher 217 782-0118

We want both Bills passed.

Download Letter to